Quick Summary

A B2B co-lending company, faced a slow and repetitive risk assessment process that took 2 weeks per customer and limited scalability. This quarterly routine needed a revamp. CRG’s RPA team used Automation Anywhere to cut a 2-week manual process to 2 days, ensuring consistent results and future scalability.

About the Customer

A leading technology-driven corporate finance firm. The business specializes in providing innovative financial solutions to a diverse clientele, including corporations, financial institutions, and investors. Through their platform, they offer a range of financial products and services, facilitating efficient capital raising, investing, and risk management. This B2B co-lending company prioritizes risk management to protect customers, uphold its brand, and foster trust through ethical practices and security. This safeguards the company and stakeholders from fraud, ensuring a secure and reliable business environment for long-term success. As of today, the risk assessment is done manually and takes around 2 weeks processing time. The data is collated in an excel format, which is not standardized posing challenges to scaling up, especially when the organization is growing, and it is highly people-dependent, who come with a lot of expertise.

Problem Statement

The manual process used in screening and assessing customer loan application process is prone to errors and inconsistencies, leading to delays in loan approvals and potential losses for the company. The documentation work like ALM, Borrower Profile, Collections Efficiency, Write-Off’s in customer risk analysis consumed time and resources overseeing every single worksheet. The verification process almost took 2 weeks for every single application.

Solution

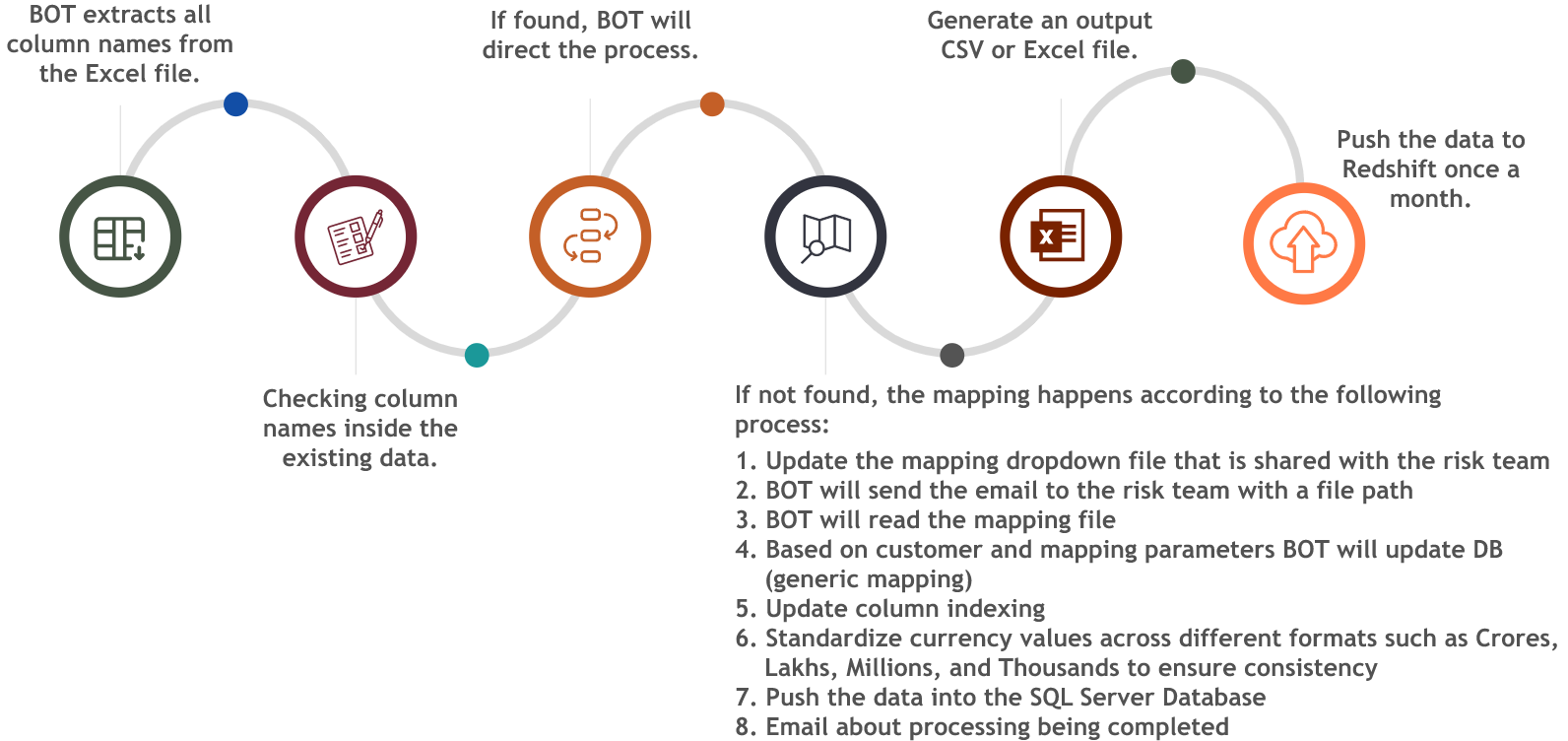

CRG Solutions created an intelligent “BOT” to gather data from diverse clients, files, formats, etc., and compiled it into a single file. The process extracts column names from an excel file, verifies them in the mapping system, and maps them if not found. The risk team and BOT then update the database based on customer and mapping parameters. Currency calculations are standardized, and database indexing also takes place before pushing data into the SQL server. Finally, monthly outputs are delivered to RedShift in CSV and Excel format.

High level Solution Architecture

The high-level solution architecture involves sending an email to the risk team with a file path, followed by the BOT reading the mapping file and updating the database based on customer and mapping parameters. Currency calculations are performed to standardize values, and the data is pushed into the SQL Server DB before generating an output in CSV or Excel file and pushing the data to Redshift once a month.

Business Benefits

Leave a Comments

You must be logged in to post a comment.